Reworking the Manhattan Airbnb Analysis 🏙️

From First Draft to Final Deliverable

A Story of Growth

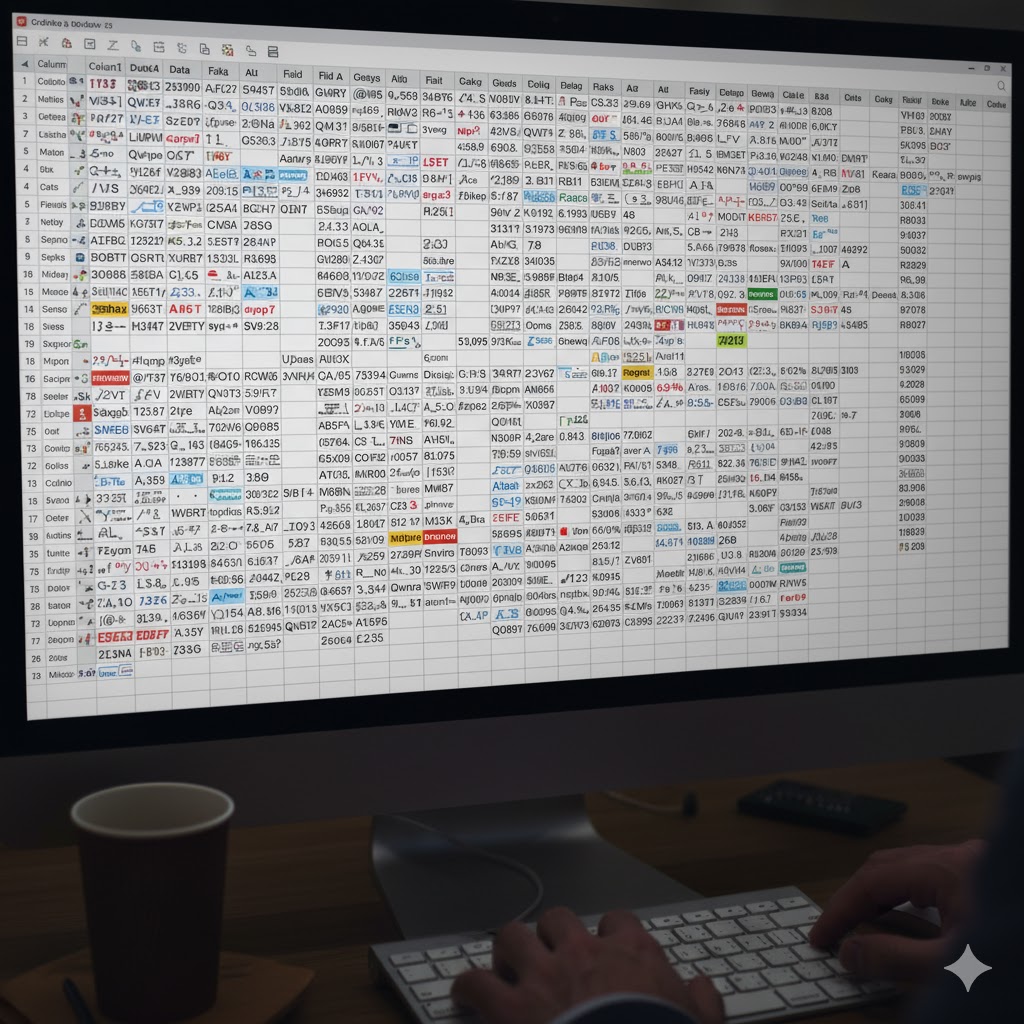

Sometimes, the most valuable projects are the ones you do twice. Let me be brutally honest: when I first analyzed the Manhattan Airbnb market back in 2023, it was my very first spreadsheet analysis. I was brand new to the field, and I was simply going through the instructed motions. Trying my best to put together skills I recently learned. Little did I know at the time, but that is a skill in itself!

After graduating from my bootcamp in 2024, I looked back at that initial project and had a blunt realization—it sucked. The basics were there, but it wasn't a polished, professional deliverable ready for a CEO. So, I decided to rework it from the ground up. I wanted to go beyond just following steps and perform a deeper dive, turning it into a strategic guide that could truly help an investor break into one of the world's toughest markets.

The challenge remained the same: advise a new-to-the-scene client on what type of vacation rental to invest in, using public Airbnb data as our guide. This time, however, I approached it with a completely new perspective.

Finding the Sweet Spot

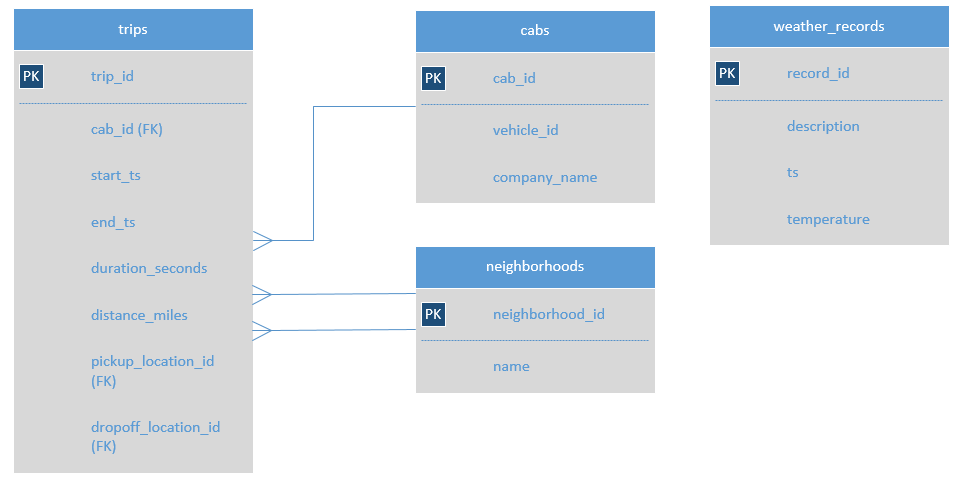

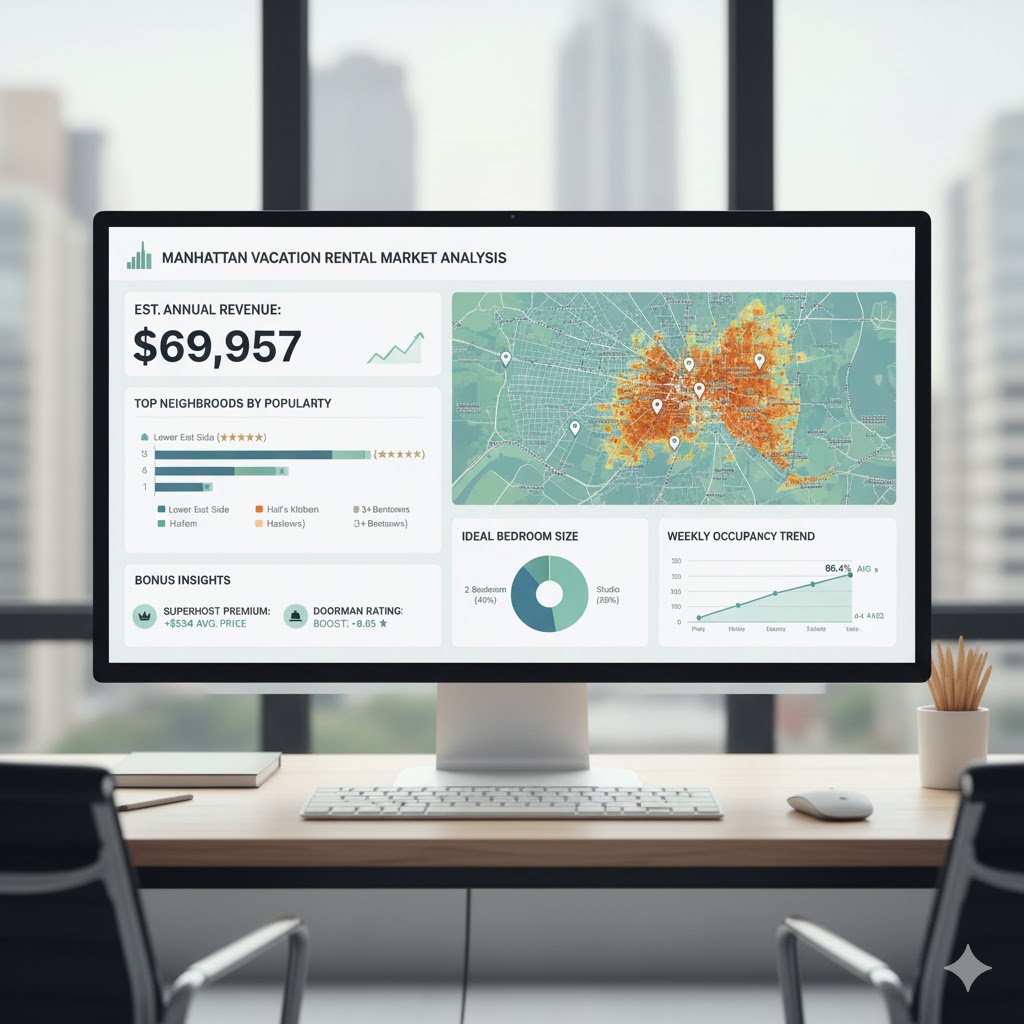

My mission was to create a data-backed investment profile. I focused my analysis on short-term rentals only and looked for the "sweet spot" by focusing on a few key metrics:

- Popularity: I used the number of reviews in the last 12 months as my primary proxy for popularity.

- Property Profile: I analyzed which neighborhoods and what number of bedrooms were most in-demand.

- Revenue Potential: I calculated an estimated annual revenue based on the characteristics of top-performing listings.

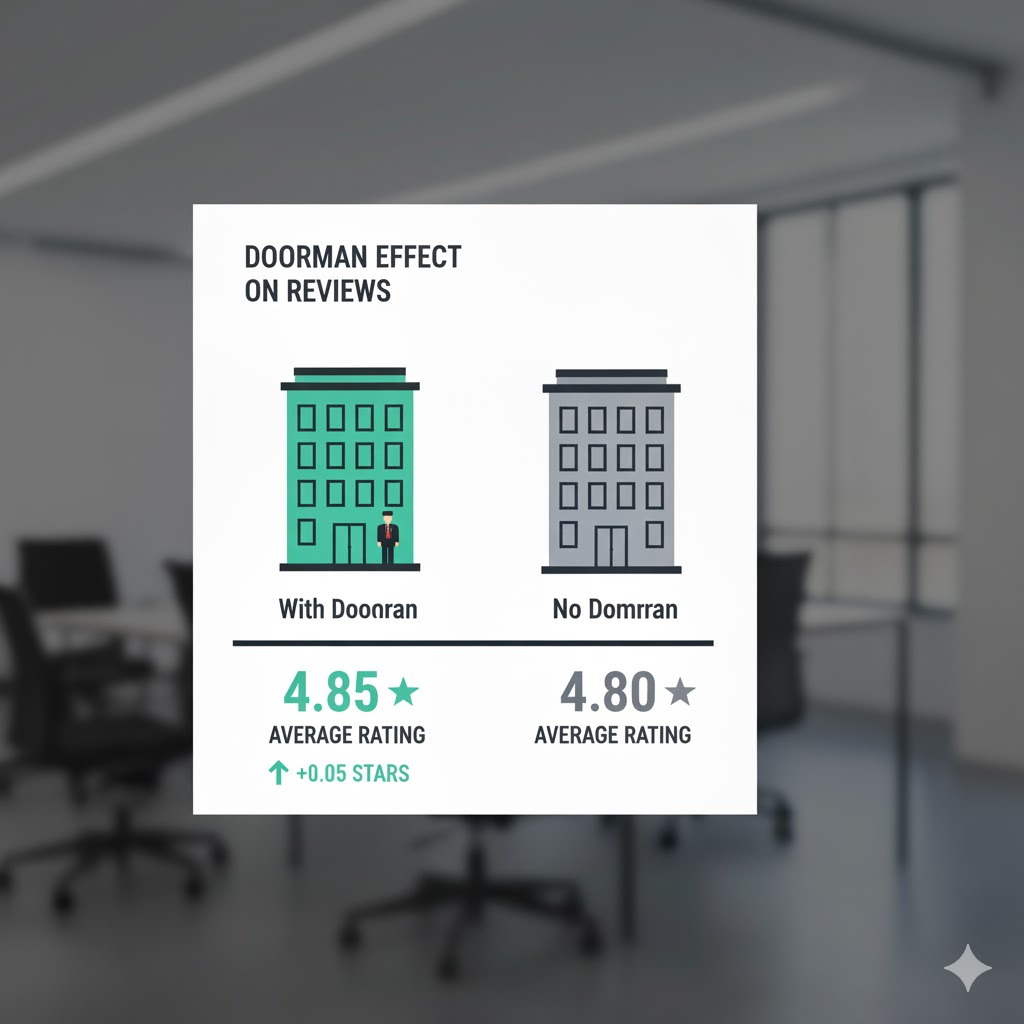

- Deeper Factors: I also dug into secondary factors, like whether having a doorman or offering instant booking really made a difference.

The Manhattan Investment Blueprint

The data painted a surprisingly clear picture of what success looks like in the Manhattan Airbnb market. This should be transferrable to any other short term vacation rentals in the area.

The top recommendation was clear: invest in a one-bedroom property in the Lower East Side. However, the data also showed that the "perfect" property isn't one-size-fits-all across the island. For instance, while one-bedroom units are the overall winner, renters in Hell's Kitchen prefer two-bedroom properties, and in Midtown, studios are king.

Here are some of the key takeaways I presented to the client:

- Top Neighborhoods: The most popular neighborhoods included the Lower East Side, Hell's Kitchen, Harlem, and Midtown.

- The Money Maker: Following the ideal property profile could yield an estimated annual revenue of $69,957.

- Bonus Insights: Little things make a big difference! Properties with doormen get slightly better reviews, and Superhosts can charge significantly higher prices (an average of $334/night).

What I find most interesting is that I don't personally know these neighborhoods like a local. My recommendations weren't based on gut feelings; they were driven 100% by the data. It’s a perfect example of how business intelligence provides a clear, unbiased path forward, even in an unfamiliar landscape.

Want to see the data?

You can explore the full analysis in the Google Sheet at the GitHub link below!

View Project on GitHubWant to Learn More?

If you’re curious about market analysis, I’ve got a resource for you:

- TripleTen: An online coding bootcamp that enables people with busy lives to make the transition into tech. My Discount Link